Does a great product make a good stock?

It's easy to look at successful companies like Apple and assume their success was obvious. Apple disrupted the market by reinventing the smartphone, which in retrospect seems like a clear genius move. However, hindsight often makes things look simpler than the reality of the time.

Blackberry was the smartphone king and had a strong footprint with enterprises thanks to its security and physical keyboard. In retrospect, the iPhone design alone wasn’t necessarily the defining winning trait, but the ecosystem of apps that won over many. Former Microsoft CEO Steve Balmer was so confident of their Windows Phone at the time that he laughed at the “over priced” iPhone. Even someone at the pinnacle of the industry could not see clearly what the future held.

The reality is that in real-time, it is difficult to see who will be the winner, and to complicate matters further, the best product doesn’t always lead to ultimate victory.

In the automotive world Lucid Motors has garnered significant attention due to its innovative products and engineering prowess. The company, founded by former Tesla engineers, aims to address some of the gaps left by Tesla's rapid innovation. The Lucid Air, their flagship model, has been lauded for its impressive features and high performance.

In March 2022 Jason Camisa, a renowned car reviewer, released the widely viewed “The Lucid Air is a time machine” video on YouTube which speaks to how phenomenal of a car it is and how it outpaces nearly all its rivals.

Despite the glowing reviews, the question remains: does a great product equate to a good stock investment?

Lucid's Financial Health

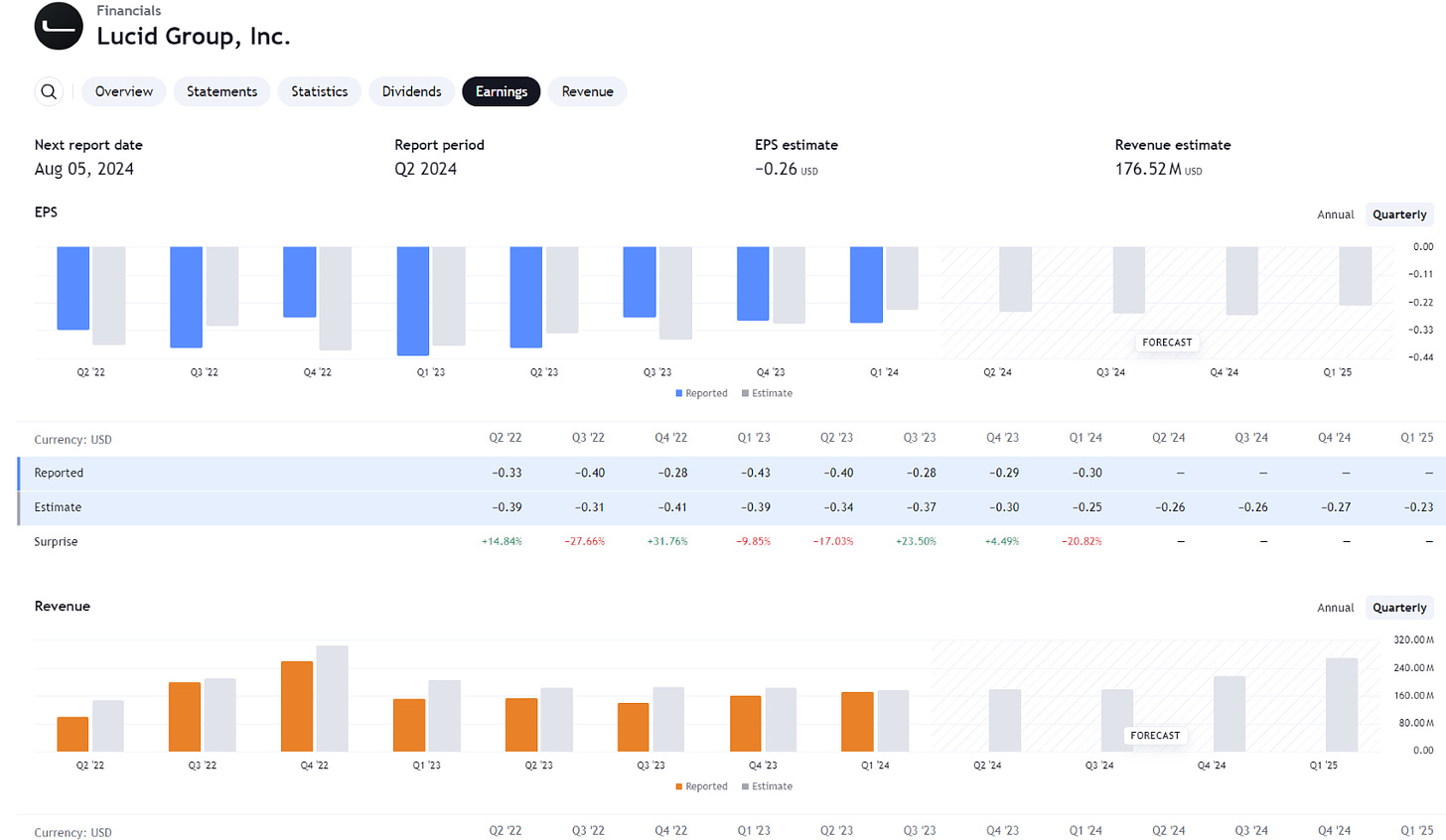

From the time Jason released his Lucid Air review, the stock has been a disaster for investors. If you look at the two charts below, you’ll see that despite a great product, Earnings Per Share (EPS) have been persistently negative and the result… a 90% drop in the stock price

Figure 1Quarterly EPS & Revenue

Figure 2 LCID Weekly Chart since inception

The Importance of Management

Successful stock investments require a combination of factors:

-

Innovative product

-

Efficient operations

-

Strong management

Regardless of how great your product is, if you can’t get it to customers in an effective manner, you will only see losses and eventually go out of business. Operations are the defining element that allows a great product to transform into a great company. It is competent management that drives efficient operations and who build the vision of how to continually improve a product and outwit rivals – just as Steve Jobs did with the iPhone.

It is no coincidence that most of the greatest companies are founder-led. Think of AAPL, AMZN, TSLA, FB, and more… they had great products and strong driving management that wanted to build a company, not take a paycheck.

Learning from the Past

Investors often look back and see the success of companies like Tesla and Apple and think that their success was inevitable. It does make for great storytelling. However, during their growth phases, these companies faced numerous obstacles and uncertainties.

In fact Elon Musk revealed that the carmaker was “about a month” from bankruptcy during the run-up in Model 3 production as recently as mid-2019!

With this in mind, price action is the best way to protect yourself from a company that is failing despite a great product. Institutional investors, insiders, and product specialists will always have greater knowledge than generalist investors. The drawback for institutional investors is the need to purchases substantial sums of stock when they think a company is a great investment. Therefore, all stocks under accumulation will embark on an identifiable uptrend long before they get to their peak valuation. By letting a stock’s price enter an uptrend, you remove the risk that you have fallen in love with a great product but a bad company – such as Lucid Motors.

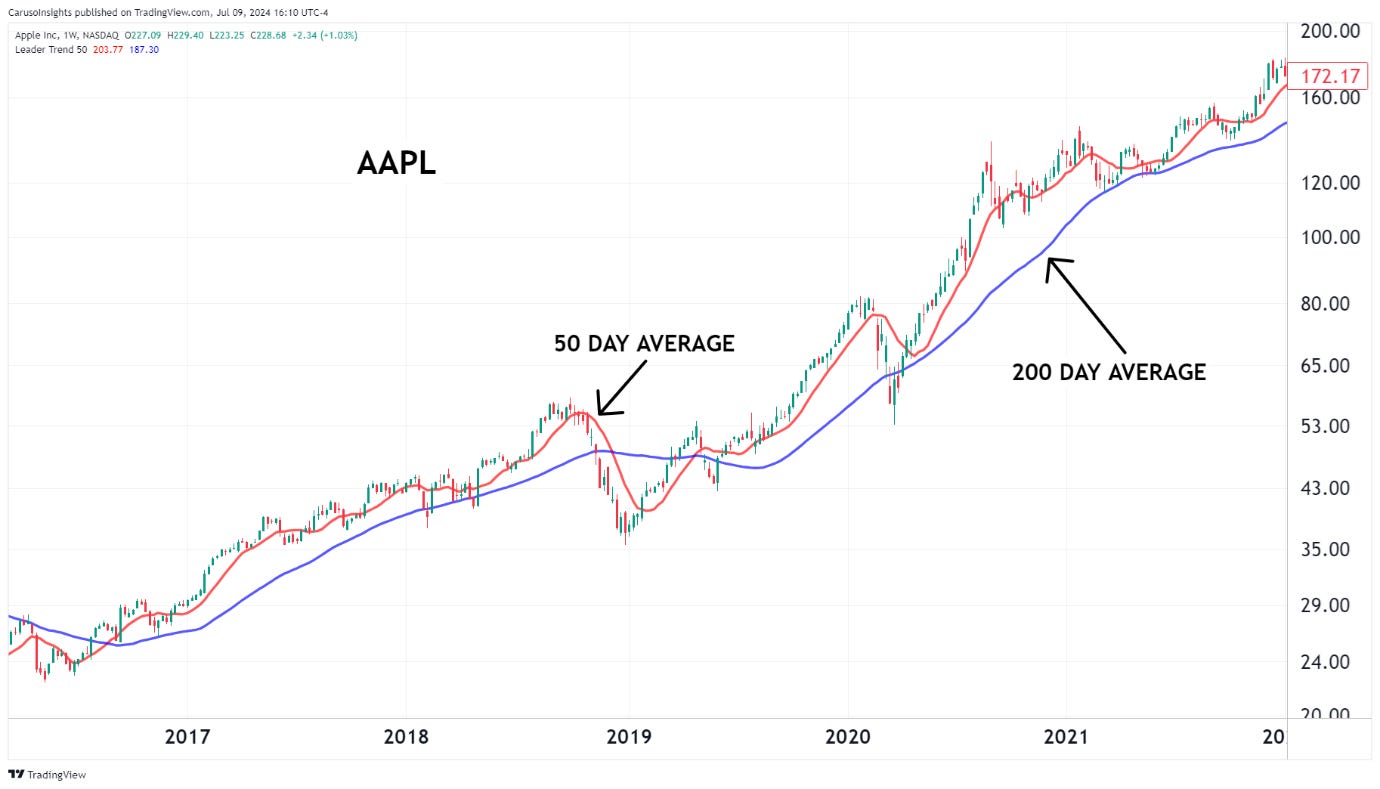

To keep things simple, an uptrend can be defined as a stock trading above its 200 day moving average. Or, for more aggressive investors, a 50-day average. As you can see in the following two charts, LCID was below a declining 200 and 50-day average for almost its entire decline. Inversely, AAPL was above a climbing 200 and 50-day average for almost its entire ascent.

Figure 3LCID with averages

Figure 4LCID with averages

Conclusion

Lucid Motors exemplifies how an outstanding product doesn't always translate to a successful stock. The company's financial struggles and management challenges highlight the complexities of finding truly incredible growth companies.

Investors must consider multiple factors, including the company product line, operational efficiency, and management effectiveness, to find outstanding opportunities. By learning from past successes and failures and using simple yet effective rules to avoid critical errors in misjudgment, investors can develop strategies to capture significant upside while minimizing risks.

Legendary investor William O’Neil simplifies the balancing act between a great product, company, and stock with one of my favorite quotes, “The only good stock is a stock that goes up.”